- WIF might just be ready to bounce back, as the TD Sequential indicator is waving a buy flag.

- It seems the Whale Index is on the rise, hinting that our aquatic friends are hoarding WIF like it’s the last slice of pie!

Ah, the cryptocurrency market! A wild beast, full of ups and downs, much like a cat on a hot tin roof. But for those who can read the signs, it offers a treasure trove of opportunities.

Recently, our dear friend dogwifhat [WIF] has been sending out signals that it might just be ready for a price rebound. Hold onto your hats, folks!

Signs of momentum shifting for WIF

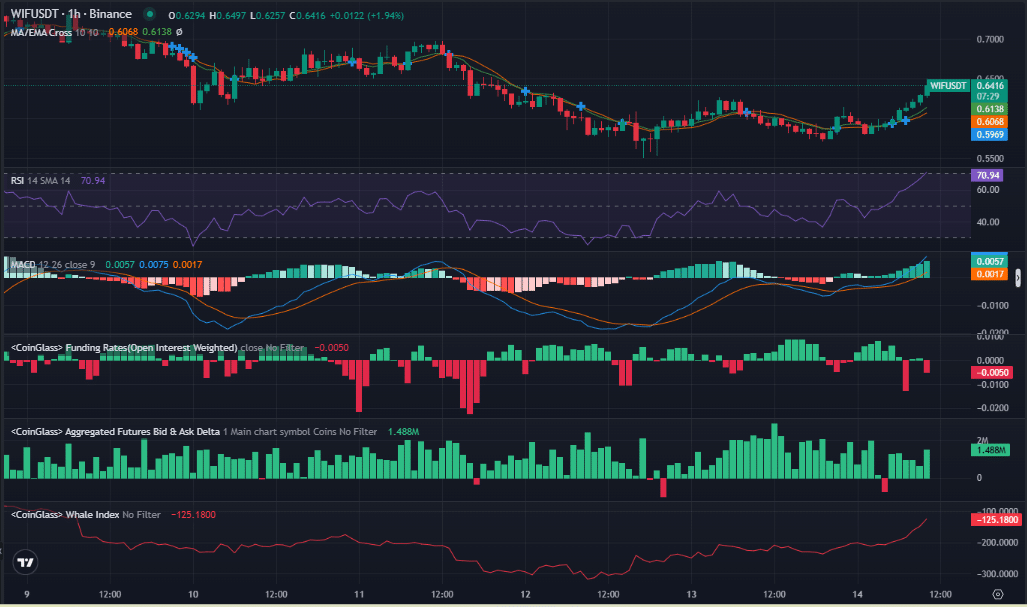

Now, if we take a gander at the 1-hour chart, we see WIF took a little tumble, but fear not! It’s showing signs of a slight recovery, like a cat that always lands on its feet.

This little dance of prices indicates that WIF is testing its support levels, with the RSI at 14, which is about as oversold as a pair of shoes at a yard sale.

Such conditions often precede a price rebound, much like a sneeze before a big “Achoo!” And let’s not forget the MACD, which is showing a bullish crossover—classic signs that the tide might be turning.

With the RSI feeling a bit under the weather and the MACD crossover waving its bullish flag, it seems WIF is gearing up for a price rebound, just in time for the party!

TD Sequential’s buy indicator

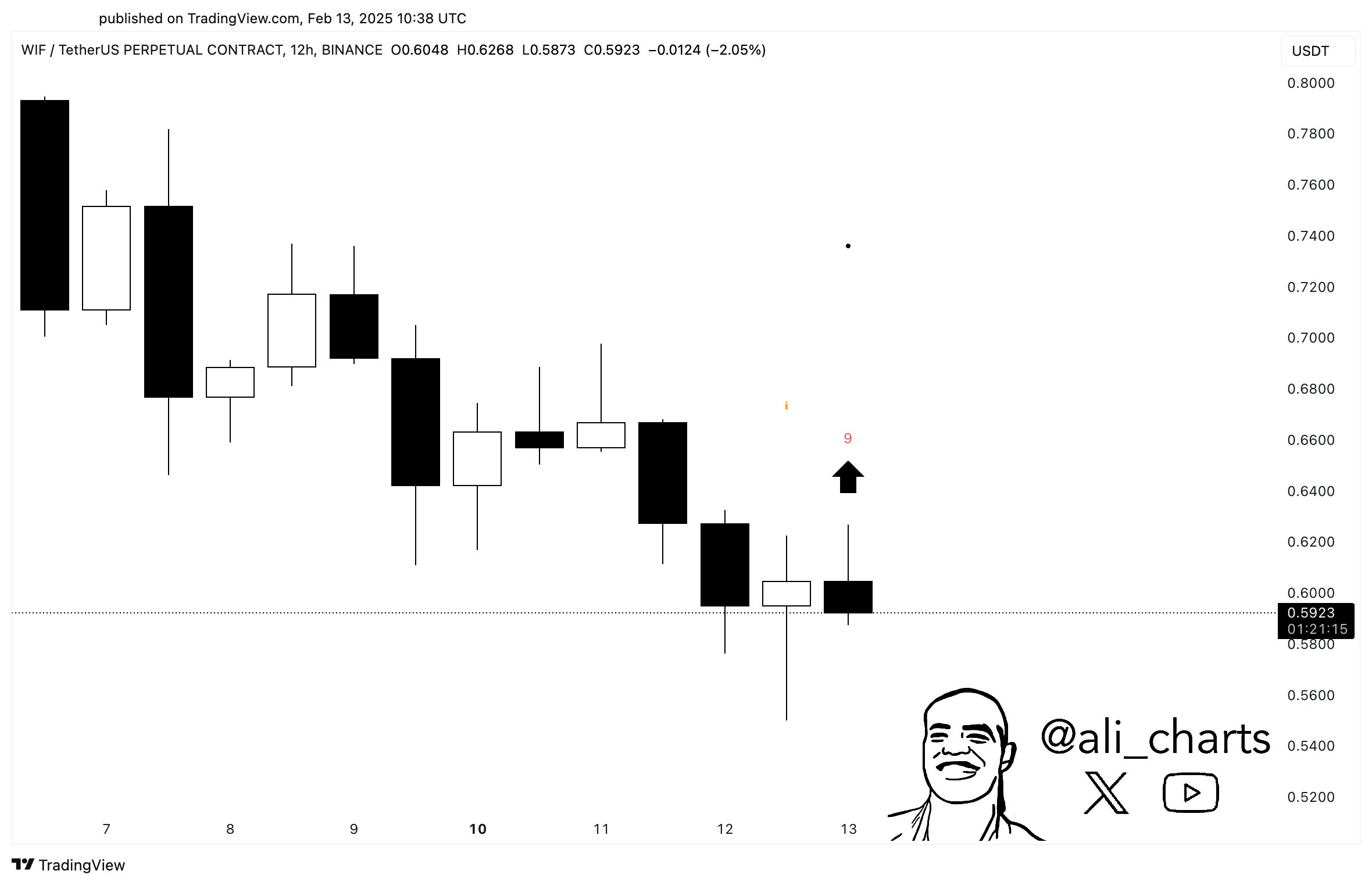

Now, let’s talk about the TD Sequential indicator on the 12-hour chart, which has decided to flash a buy signal for WIF. This is like a neon sign in a dark alley, folks! The TD Sequential is known for spotting exhaustion points in a trend, much like a tired dog after a long walk.

A buy signal on a longer timeframe, like the 12-hour chart, is particularly noteworthy. It suggests that the downtrend might be nearing its end, much like a bad joke that finally gets a laugh.

This is a clear indication of a potential rebound, reinforcing the notion that $WIF might soon be strutting its stuff upward!

Positive shifts in buying pressure

Further analysis reveals that the Funding Rate for WIF is slightly negative, which means shorts are paying longs. This suggests that market sentiment is leaning toward expecting a price increase, like a crowd waiting for the curtain to rise.

Additionally, the bid-ask delta is showing positive spikes, indicating that buying pressure is on the rise. This buying pressure, combined with the negative Funding Rate, implies the market is getting ready for a possible price rise, like a pot about to boil over.

These signals collectively suggest that WIF could be gearing up for a rebound, much like a rubber band ready to snap back!

Are large holders positioning for a rise?

The Whale Index for WIF reveals that our large friends (whales) are showing signs of accumulation. It’s like watching a group of kids gather around a candy store!

The recent surge in the Whale Index suggests that these whales are starting to hoard WIF, a behavior that often precedes price increases. It’s like they know something we don’t—perhaps they’ve got a crystal ball or just a good hunch!

This pattern mirrors earlier price action, where the price is recovering from a low point, much like a phoenix rising from the ashes.

Whale activity supports the idea that these large investors expect a price rebound, which could push the price of WIF higher in the short term. So, keep your eyes peeled, folks!

The analysis of WIF’s recent technical indicators presents a strong case for a potential rebound. Additionally, market sentiment, as indicated by the Funding Rate and bid-ask delta, points toward a price increase. Whale activity aligns with these expectations, as large holders accumulate WIF in anticipation of a price rebound.

- Dogecoin Whales: Trò chơi chờ đợi tuyệt vời năm 2025! 🐋💰

- Tín hiệu bí mật của ETH? 🚀🤯 Bạn sẽ không tin những gì tiếp theo!

- MUSK MUSK Hushed Prophecy: Doge rất sớm ?! 😱

- Grayscale từ 2025 Altcoin chọn

- Đáng kinh ngạc ETF Xuất hành Tariffs Ignite Mayhem?

- Bỏ qua các huyền thoại: Khám phá cơ quan tiếp thị tiền điện tử tốt nhất năm 2025! 🤔💰

- Crypto Chaos: CZ’s Laughable Listing Dilemma! 😂

- Tình huống khó xử về đạo đức của tiền điện tử

- Hóa đơn thuế tiền điện tử kỳ quặc của Ohio: Nó sẽ khiến bạn trở nên giàu có hay chỉ bối rối?

- Bitcoin’s Strive Plunge: Những gì bạn cần biết trước khi hoảng loạn! 😱

2025-02-14 23:07